by Kathe Barge | Aug 26, 2022 | Buyers, Buying Conditions, Contracts, For Sale By Owner, Helpful Tips, Home Improvements, Inspections, Listings, Property Updates, Property Value, Real Estate, Sellers, Sellers-Contracts

We find the inspection process confusing – do we have to fix everything in the inspection report before we close on our home or just the repairs the buyer requested?

The home inspection report is the document from which your buyer works to make their repair requests of you. Some buyers will ask for everything and others will ask for only those items that they think are important. They may let some things go, for example, if they are planning on renovating an area and anticipate fixing those items as a part of the renovation.

Once you and your buyer agree on a list of repairs, these are memorialized on an addendum. It is that addendum, called a Change in Terms Addendum (“CTA”), from which you work when completing your repairs. You need not refer to the inspection again unless the CTA references it. You do, however, need to make sure that you do everything on the CTA exactly as specified, so be sure to read it carefully and provide a copy to your contractor(s). For example, if the CTA says that you will have GFCI outlets installed by a licensed electrician then you need to make sure you hire a licensed electrician, and not your favorite handyman, to make the repair! If the CTA says you must paint to match existing then you need to take a sample of the existing paint to the paint store and color match it – don’t rely on old paint in cans – paint fades with age and it won’t match. Be very careful to be sure you are complying with the terms of the CTA – if you do not, or if your contractor does not, your closing may be delayed or postponed until the work is done as specified. Along those lines, be sure to review your contactor’s work when complete and make sure that he actually did what you agreed to do on the CTA. If not, request that he return before it becomes a walk-through issue.

And of course, be sure to get paid receipts from all contractors, or if they have not been paid, notify the closing company so that they can be paid at closing. All repairs must be paid for before ownership changes hands so be sure to stay on top of your bills, and provide receipts to the buyers agent.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Aug 8, 2022 | Buyers, Buying Conditions, Design, Downsizing, Helpful Tips, Home Improvements, Home Staging, Inspections, Market Trends, Property Updates, Property Value, Real Estate, Sellers, Selling Conditions

We aren’t ready to move but want to update our home – what are the best choices for paint colors and flooring changes, assuming we may want to move in the next few years?

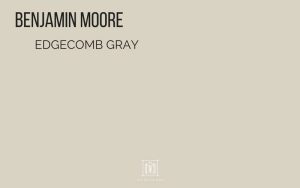

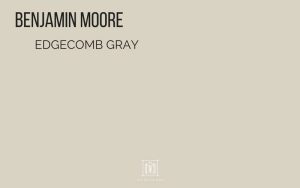

New paint colors must harmonize with the rest of your home, unless you plan to repaint the entire interior of your home, so any suggestions need to be taken in the context of what else is going on inside your home. My best suggestion for a currently fairly timeless paint color is Benjamin Moore’s Edgecomb Gray. This color blends with virtually every shade of white that might be on your trim and nearly every color flooring that might be in your home. It is really more of a greige than a gray and, like a chameleon, changes color a bit depending on what is in the space and what kind of light is filtering in through the windows. However, if your home is a palette if golds, for example, this color might not be the right choice! Trending now is white on white (with trim and walls painted the same or nearly the same shade of white), but this is a design style that is best incorporated throughout the entire home, and not just a singular room. If you have wallpaper in your space, then it’s a very good investment to have it removed (do not paint over it, no matter what the painter tells you) and painted in a color that coordinates with your design aesthetic. Wallpaper overall remains a difficult sell.

This color blends with virtually every shade of white that might be on your trim and nearly every color flooring that might be in your home. It is really more of a greige than a gray and, like a chameleon, changes color a bit depending on what is in the space and what kind of light is filtering in through the windows. However, if your home is a palette if golds, for example, this color might not be the right choice! Trending now is white on white (with trim and walls painted the same or nearly the same shade of white), but this is a design style that is best incorporated throughout the entire home, and not just a singular room. If you have wallpaper in your space, then it’s a very good investment to have it removed (do not paint over it, no matter what the painter tells you) and painted in a color that coordinates with your design aesthetic. Wallpaper overall remains a difficult sell.

As to flooring, real wood floors remain the best investment you can make. They are timeless and easy to refinish if they become worn or if the buyer prefers a different color. I highly recommend choosing a medium tone brown, not too yellow, red or dark and preferably in ¾” thickness. If engineered wood floors are what your budget requires, choose one that the manufacturer indicates can be refinished at least once, and keep a few extra pieces on hand in case you damage any through normal wear and tear. Bamboo is another great option and there are on-line suppliers that offer a variety of shades in ¾” planks – it is very resilient, environmentally friendly and installed can look like hardwood. I do not recommend that you choose the latest trend, “LVL” (luxury vinyl flooring), for anything beyond the basement level of your home. These are plastic floors, and if your home will likely sell for over $500,000, these floors will not be appreciated on the main or upper levels. Finally, carpet in a neutral tone plush (no berber, no mixed colors) is acceptable as long as they are clean and stain free. If you stain them during the remaining time in your home, you would need to replace them again before you sell your home.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jul 12, 2022 | Buyers, Buying Conditions, Helpful Tips, Inspections, Listings, Real Estate, Security, Sellers, Selling Conditions

How do home sellers protect themselves from big walk through bills from a buyer?

Buyers conduct a final walk through right before they close on a home. This is probably the first time they have seen your home vacant. If they find conditions they aren’t expecting, you can expect a bill at the closing or a last minute request to remedy the condition.

What kinds of things might come up? There are many things that can cost you money at a walk through. Here are a few. If you have any damage to your floors (even if it was there when you bought the home) and you failed to list the damage on your disclosure, and it wasn’t obvious when you walked through your occupied home (under rugs or furniture), you can expect that the buyer will expect you to pay for the repair/replacement when he discovers the issue, which could be a significant expense. What should you do? Disclose. Disclose. Disclose! When you list your home, take the time to make sure your disclosure lists every possible condition issue with your home.

If you leave anything behind that isn’t attached or specifically included, you should anticipate you may be required to call a last minute hauler to remove the items. If the items were there when you bought the home, that’s no excuse. The house must be empty when you leave unless you have the buyers’ specific consent to leave the items behind.

Forget to cut the grass in a few weeks? You could be asked for a credit to have the lawn mown. Forget to clean the house? If its not at least “broom swept clean” you could be paying a cleaning fee. Forget to complete your inspection repairs or forget to check the work and make sure it’s done correctly? You can’t rely on the contractors to get it right – you must check the work – if they didn’t finish or did the wrong thing, you will likely have to pay for the repair again. Accidentally remove an inclusion such as the TV wall mount bracket? You may have to pay for a new one.

Take the time to make sure the home is exactly as you would want it were you moving in and be pro-active with your buyers if you discover any issues on your move out to avoid any closing table surprises.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jun 13, 2022 | Buyers, Buying Conditions, Contracts, Helpful Tips, Inspections, Listings, Property Value, Real Estate

What kinds of items would be viewed as “hot buttons” for home buyers on inspections?

If you are a home seller, there is an ever increasing list of items that you will be expected to address if any are discovered on your home inspection. Given that, if you are thinking about selling your home, it would be a good idea to determine if any of these conditions exist at your home and remedy them prior to listing your home. Items that sellers are generally expected to address these days include:

Radon: if your home exceeds 4.0pCi/l, you will be expected to remediate the radon, even if it was a low reading when you bought the home. Radon varies over time. The estimated cost for a system is approx.. $1300.

Mold: If there is mold anywhere at all, you will be expected to have it remediated. Basements and attics are the most obvious places mold hides out, but be sure to check showers and under sinks.

Electrical: If you have knob and tube wiring, you will likely be paying for it to be removed and replaced, unless you price your home with a rewire in mind and disclose its presence. If your home has any Pushmatic brand electrical panels, buyers will also expect those to be replaced.

Broken Seals: if you have thermopane windows, doors or skylights in your home, buyers will expect you repair the broken thermo seals. This is evident because the windows have a cloudy look to them. There are a few companies in Pittsburgh that can do this reasonably affordably.

Septic/Sewer: Sewer lines are the newest “must do” inspection. If a buyer finds roots in your sewer line, at a minimum you will be expected to clear the roots from the line, but if they are bad you will be expected to line or replace the line. This can be extremely costly so I highly advise that you camera your own lines in advance of selling and get them in good shape.

You can be certain that if any of these conditions exist in your home, you will be expected to remedy the condition unless you disclose its presence and price accordingly.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jun 9, 2022 | Blog, Buyers, Buying Conditions, Contracts, Helpful Tips, Inspections, Listings, Property Updates, Property Value, Real Estate

We find the inspection process confusing – do we have to fix everything in the inspection report before we sell our home or just the repairs the buyer requested?

The home inspection report is the document from which your buyer works to make their repair requests of you. Some buyers will ask for everything and others will ask for only those items that they think are important. They may let some things go, for example, if they are planning on renovating an area and anticipate fixing those items as a part of the renovation.

Once you and your buyer agree on a list of repairs, these are memorialized on an addendum. It is that addendum, called a Change in Terms Addendum (“CTA”), from which you work when completing your repairs. You need not refer to the inspection again unless the CTA references it. You do, however, need to make sure that you do everything on the CTA exactly as specified, so be sure to read it carefully and provide a copy to your contractor(s). For example, if the CTA says that you will have GFCI outlets installed by a licensed electrician then you need to make sure you hire a licensed electrician, and not your favorite handyman, to make the repair! If the CTA says you must paint to match existing then you need to take a sample of the existing paint to the paint store and color match it – don’t rely on old paint in cans – paint fades with age and it won’t match. Be very careful to be sure you are complying with the terms of the CTA – if you do not, or if your contractor does not, your closing may be delayed or postponed until the work is done as specified. Along those lines, be sure to review your contactor’s work when complete and make sure that he actually did what you agreed to do on the CTA. If not, request that he return before it becomes a walk-through issue.

And of course, be sure to get paid receipts from all contractors, or if they have not been paid, notify the closing company so that they can be paid at closing. All repairs must be paid for before ownership changes hands so be sure to stay on top of your bills, and provide receipts to the buyers agent.

A home’s value is set by the market. Value is always determined by what a buyer is willing to pay for your home. Many factors come into play in setting that value. Market value reflects quantitative factors such as: # bedrooms, # bathrooms, # garages, placement of garages (attached or integral), lot configuration (large and functional back yard? Cliff lot?), location of the home generally, age of roof, age of mechanicals. Market value also reflects more qualitative items: how updated is your home, and is it all new, or just refreshed? What is the floorplan (open concept?) What are your wall colors? There is always a range that value will land in, which we call the range of reasonable. There is no ONE price at which a home will sell. If there are many buyers seeking a home like yours, it will sell at the top of the range of reasonable. If there are not, it will take longer to sell and may sell a bit lower in the range. What the market does not consider in setting a value of a home is what you need from the home. In 2008, many homeowners had used their homes as ATMs and withdrawn large sums of money for educations, vacations and cars. When the market softened, there was not enough equity for them to be able to sell their homes and not be in a short sale situation. This fact, that a homeowner over-extended themselves on mortgages, is not the least bit relevant to market value. The market is also not going to consider what you plan to do next. If you plan to move to Los Angeles to be closer to family and are finding that the Pittsburgh market is not going to yield you enough to be able to buy in L.A., you will need to turn to other investments to make up any difference.

We are in a very robust market – your home is far more likely to garner more now – whatever that may be – than it could have in the past. Forecasters are also suggesting that values will soften by year end. My crystal ball is out for service, but what I can tell you is that every hot market eventually softens. Waiting out the market so that you can get a price that the market is unprepared to deliver at this time may have you waiting many, many years, and during that time you may need to invest even more in your home in order to deliver to the market what it needs in order to deliver an acceptable sale to you.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Mar 30, 2022 | Buyers, Buying Conditions, Contracts, Helpful Tips, Inspections, Listings, Market Trends, Property Updates, Property Value, Real Estate, Sellers

The market is so hot right now and we aren’t having any luck getting a home – should we waive home inspections?

You are correct –the market under $1million is very fast paced right now, and in many instances, the winning bidder has waived home inspections. That does seem to be what it may take to “win” right now but I cannot recommend that you make that choice. Now several months into the “waive inspections” craze we are starting to hear stories about the expected fallout from this hasty decision.

From the seller’s perspective, I highly recommend that you have your home pre-inspected and repair or disclose the relevant items. While an inspection might cost you upwards of $500, it is money well spent toward a smooth closing. If you have pre-inspected your home and provide the report to prospective buyers, you are doing your part to make sure your buyer is well-informed. In the absence of a pre-inspection, I do not recommend that you accept an offer from a buyer who has not inspected your home. I have started hearing from home inspectors that disgruntled buyers are seeking post closing inspections to find problematic items and sue the sellers for failure to disclose. You don’t want that to be you. If you have not pre-inspected, we can discuss strategies to allow a buyer’s inspection and still protect you.

From a buyer’s perspective, as we all imagined would happen, the post-closing stories are starting to mount about buyers who purchased without an inspection and are now having all sorts of forseeable issues – roofs leaking, furnaces failing… If you are going to make this risky choice, you need to do so knowing that you will be assuming the risk of potentially tens of thousands of dollars of issues The contract specifically states that your inspection is your opportunity to find issues – if you waive that, you will be fighting an uphill battle to recover against anyone. Before you make an offer without an inspection contingency, you really do need to ask yourself if you are prepared to absorb those costs!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Mar 8, 2022 | Buying Conditions, Helpful Tips, Inspections, Listings, Market Trends, Real Estate, Sellers

Our neighbor just had to replace their sewer line – is that a common home inspection repair?

Sewer lines have become as radon was 20 years ago – today’s hot button for home buyers. In some boroughs (Mt Lebanon, for example) the borough now requires that before a home seller can transfer ownership, the sewer line must be scoped and must be without issues. Here in the Sewickley area, we do not have any boroughs imposing any such requirement on home sellers yet, but many buyers today do have a scope performed of the sewer line as part of their home inspection. And yes, if issues are discovered, they do expect the seller to remedy them. If a sewer line needs to be replaced, the cost will likely be between $5,000 and $10,000.

Sewer lines are not something we think about on a daily basis. As long as we don’t have back-ups, we assume that all is well with the line. But this is not necessarily the case. With older homes, sewer lines were made of terracotta pipe and this can break easily and can also be easily infiltrated by tree roots. If you live in an older home and haven’t replaced your sewer line, there is a good chance you have some issues.

Paying for a sewer camera test is not anyone’s idea of a good time, but if you are contemplating a sale of your home, it is probably a smart, pro-active thing to do. If you discover a problem in advance, there may be some cost-effective options for you to solve the problem without a full replacement of the line. Sewer lines can often by lined with a plastic liner. Tree roots can often by removed by hydrojetting. If you wait for a buyer to perform the test, you may get stuck with a full new line — the buyer might not accept one of the compromise options. So its best to explore the sewer line now, before it becomes an issue, and make any needed corrections.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Feb 2, 2022 | Buyers, Buying Conditions, Inspections, Listings, Property Updates, Property Value, Real Estate, Sellers, Selling Conditions

Sometimes it seems like everything is breaking around our house and we get behind on repairs. Isn’t there some level of wear and tear buyers of “previously enjoyed” homes are expecting to have to accept?

The process of selling and buying a home involves many fine lines. How far do you take preparing your home for sale? Do you really need to address all of the items suggested by your agent, the home stager or the home inspector who did a pre-inspection? Do you really have to attend to everything your family has broken or worn out over the years

Anything that could come up on an inspection, if you know about it, really must be repaired or disclosed. My vote is repair. Even with items that are very obvious, when an inspector gets involved, he may blow the issue out of proportion and something that might have cost you $1000 to repair before you listed ends up costing you $3000 on the inspection request. If its something an inspector might find, you can bet he will find it and you will be expected to cover the cost of repair anyhow, so you might as well repair upfront.

Many buyers actually get quite nervous during the home inspection (also known as buyers remorse). If you happened to have gotten one of these buyers, it is possible that they could walk away from your deal if the inspection concerns feel too weighty to them. After you actually receive and negotiate the offer, the last thing you want to do is lose the buyer over items that you could have fixed but didn’t think anyone would notice or care about! In today’s market, they notice, they care. Sometimes they are willing to let you pay for the repair. Sometimes they just walk. Don’t take any chances. If you suspect it is likely someone would seek a repair, get it done!

Buyers, as much as I advocate for sellers to take care of the wear and tear items on their homes, it is important for you to be reasonable on your inspection requests as well. If you see an item that needs to be fixed while you are touring the home, take that into account when you make your offer and do not revisit it on the inspection. Inspection requests are supposed to be for items you didn’t know about and didn’t have a chance to adjust for in making your offer. Again, its a fine line buyers also walk in deciding what are fair and appropriate inspection requests of a seller.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Sep 7, 2021 | Blog, Buyers, Buying Conditions, Contracts, Inspections, Listings, Market Trends, Marketing, Mortgage, Property Value, Real Estate, Sellers, Selling Conditions

We hear selling a home can be a trying process. Any annoyances a seller should be expecting?

Below is a short list of many of the “joys” sellers might experience during the listing process. Being aware that these are possibilities will hopefully help you take them in good humor if they happen to you!

- The agent showing your home will miss appointments and not call or show up.

- Appointments will be made and cancelled at the last minute.

- Some showings will last about five minutes and some will last 3 hours.

- There will be a day when I call you and say someone wants to see your house, and you are going to ask me when. And I will say: “Look out your windows, they are sitting outside now”!

- Agents are going to knock on your door or even drive by, see you in the yard and ask if can they see you house.

- Agents showing your home will forget to turn lights off.

- Agents showing your home will let your pets out (best to remove them from your home for showings) or your neighbor’s pet in.

- Agents will provide unhelpful feedback – buyers buy homes when they attach emotionally to a home and when they don’t, their feedback is often nonsensical.

- Agents will not provide any feedback – incredibly annoying, I know.

- Expect lowball offers (at least it is a starting point). If your home has been on the market for more than a month, there is a reasonable chance that you priced it too high – maybe the lowball isn’t as low as you think.

- Things will come up on the inspection that you had no idea were wrong with your home and you will be sure the inspector made a mistake. A pre-inspection is a great way to protect yourself against this!

- The buyer will make ridiculous inspection requests.

- The buyer will ask to bring in contractors for estimates for work they want to do after the closing at the seemingly most inconvenient times.

- The property might not appraise at what you are selling it for. In a hot market like this one, this is a real risk. Be prepared to adjust your price if your sales price is over the listing price and it doesn’t appraise.

- The closing date on the contract may change. Lenders and closing companies remain swamped right now – be open to the possibility of a delay.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Aug 24, 2021 | Buyers, Buying Conditions, Home Staging, Inspections, Market Trends, Real Estate, Sellers, Selling Conditions

We recently viewed a home that is on the market, only to find out the seller was taping the showing – we were stunned. Is this common?

Welcome to the age of cheap technology! If you are viewing a home, whether at an open house to at a private showing, these days you must assume that you are being filmed. There are many systems that are available, from ring to nest to cameras installed as part of a home security system. They are fairly inexpensive, are often not recognizable as cameras and frequently record sound as well as video. Sellers typically install them as part of a home security or doorbell system – they are not usually installed just to spy on buyers and their agents. Typically, homeowners have security in mind when they install these systems. But when their home goes on the market, these systems do provide a handy way to see firsthand what people are saying about their home. So yes, it has become reasonably commonplace to be filmed at a minimum around the doors of a home, but often inside as well. The owners can usually access these videos in live time on their tablet or phone, and they are also recorded for later review.

Knowing this, I would suggest that you simply revert to old-fashioned good manners when viewing homes. Don’t say anything near or in someone else’s home that you wouldn’t want to see on YouTube! Don’t criticize the seller’s décor choices or the condition of the home – it may come back to haunt you if, after reviewing the inventory, you decide that it was in fact the best option for you, only to find out that you unintentionally offended the sellers. Save all commentary for when you are back in the car with your agent.

If you are viewing the home with children, be mindful of their behavior as well. Keep them with you at all times. Be sure that they are not running or jumping inside of someone else’s home or touching their things. Have a hard time managing high energy children at an open house or showing? Schedule a babysitter so that you can view the home without having to worry about monitoring their every move. And in these pandemic times, it is best to wear a mask – if the seller requests masks, your agent can be charged with an ethical violation if you don’t wear one – even if you are fully vaxxed! In this day of minimal privacy and cheap technology, the best approach is to assume you could very well be on Candid Camera!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jul 26, 2021 | Buyers, Buying Conditions, Inspections, Listings, Real Estate, Sellers, Selling Conditions

What should we expect from the Buyer’s walkthrough?

Buyers conduct a final walk through right before they close on a home. This is probably the first time they have seen their new home vacant. If they find conditions they aren’t expecting, a seller can expect a bill at the closing or a last minute request to remedy the condition. What kinds of things might come up? There are many things that can cost a seller money at a walk through. Here are a few.

If there is any damage to floors (even if it was there when a seller bought the home) and the damage was not listed on the disclosure, and it wasn’t obvious when the buyer walked through the occupied home (under rugs or furniture), a seller can expect that the buyer will expect the seller to pay for the repair/replacement when he discovers the issue, which could be a significant expense. What should a seller do? Disclose. Disclose. Disclose! When listing a home, sellers should take the time to make sure the disclosure lists every possible issue with the home.

If a seller leaves anything behind that isn’t attached or specifically included, a seller should anticipate they may be required to call a last minute hauler to remove the items. If the items were there when the seller bought the home, that’s no excuse. The house must be empty unless you have the buyers’ specific consent to leave the items behind.

Forget to cut the grass in a few weeks? A seller could be asked for a credit to have the lawn mowed. Forget to clean the house? If its not at least “broom swept clean” a seller could be paying a cleaning fee. Forget to complete inspection repairs or forget to check the work and make sure it’s done correctly? A seller can’t rely on the contractors to get it right – they must check the work – if its incomplete or incorrect, a seller will likely have to pay for the repair again. Accidentally remove an inclusion such as the TV wall mount bracket? A seller may have to pay for a new one.

Take the time to make sure the home is exactly as you would want it were you moving in and be pro-active with your buyers if you discover any issues on your move out to avoid any closing table surprises.

If BUYING or SELLING real estate is in your future, please get in touch with me and put my expertise to work for you!! As YOUR REAL ESTATE ADVOCATE, I will help you avoid pitfalls like those mentioned above. 412.779.6060

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jul 21, 2021 | Blog, Buyers, Buying Conditions, Contracts, Home Staging, Inspections, Listings, Marketing, Property Updates, Property Value, Real Estate, Sellers, Sellers-Contracts, Selling Conditions

Our home went under agreement quickly! When we moved in we installed expensive hardware that we really love (door knobs, switch plate covers, towel rods, etc.). We would like to take it with us. Can we substitute other items before we close?

Absolutely not! First of all, with a quick sale you likely got a high price or your home and when a buyer is paying top dollar, it is not appropriate to start pulling things out of your home! Additionally, any item that is affixed to your home with a screw, nail, etc. must convey with your home unless you have specifically excluded it from your agreement of sale. Unless you raise this question during negotiations and your buyer agreed prior to signing the agreement, the items must remain with your home.

About 20 years ago I represented a buyer of a home that was remodeled with high-end Restoration Hardware items – cabinet knobs, towel bars… After we agreed on a price but before closing, we returned to the home to discover that the sellers had removed the expensive Restoration Hardware items and installed baseline builder items from Lowes. This was not what my client had seen when they toured the home and not what they had agreed to purchase. The seller ended up providing a $7000 reduction in the purchase price to make up for the items that had been switched. I’m not sure if the buyer ever replaced the items – what is relevant was that the removal of the high end items made the home less valuable.

If you find yourself heading toward a closing and you are just realizing that there is something affixed to your home that has sentimental value that you forgot to exclude, you can certainly ask your buyer if they would agree to a substitution – most buyers will allow removal of a sentimental item if you replace it with a like value item. Absent buyer consent or upfront exclusion, all affixed items must stay. Items that are occasionally inappropriately removed include: appliances, doorknobs, switch covers, towel bars, curtain rods, mailboxes, attached shelving and TV wall mount brackets. Mirrors that are attached must stay. Those hanging on hooks can be removed if you have to have them (although most buyers do expect them to remain).

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jun 18, 2021 | Blog, Buyers, Buying Conditions, Contracts, Inspections, Listings, Market Trends, Property Updates, Property Value, Real Estate, Sellers

It seems buyers can be very picky on home inspections. What should a seller expect?

What a Seller needs to be prepared for on a home inspection needs to be evaluated in the context of the entire deal! Both buyers and sellers need to keep things in perspective. If a Buyer got a great deal on a home, then the inspection should be more about major things that the Buyer could never have known about. If a Seller got top dollar for a home, the Seller should expect to be very generous on the inspection resolution with the buyers. Sellers do need to expect that a buyer paying asking price or above will expect the inspection items to be addressed by the Seller unless the Seller had disclosed them on the Disclosure.

The Disclosure is a Seller’s friend. What a Seller discloses is supposed to be outside the scope of inspection requests. These are items that the Buyer should be taking into account when making their initial offer. Therefore, when filling out the Disclosure, Sellers will want to review it carefully to be sure it is thorough. Inspectors do not miss anything these days, so it will be far less of a financial blow to a seller if all possible issues are noted up front.

Of course, a pre-inspection may be a Seller’s best approach for a smooth transaction for all parties. While a seller will spend approximately $400 up front, it gives you a chance to repair or disclose the issues before they possibly destroy a deal. Remember, if buyers and sellers can’t come to a resolution about inspection concerns, the deal is terminated and both parties move on. Sellers, you obviously want to sell or you wouldn’t be undergoing the joy of preparing your home for showings. Keep the big picture in mind and understand that unless you are giving your home away, your buyer will expect you to fix what you didn’t disclose. Don’t like the sound of that? Pre-inspect so you know what you will have to address upfront.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Apr 5, 2021 | Buyers, Buying Conditions, Inspections, Market Trends, Property Updates, Real Estate, Selling Conditions

The market is very hot right now and we are having no luck winning a bidding war. Should we waive inspections?

It’s certainly true that waiving inspections will make your offer much stronger than a competing offer in which the buyer is inspecting the home. Most sellers would gladly choose an offer waiving inspections over one that is not. However, before you make such a bold choice, you do need to consider the consequences.

If the seller has pre-inspected the home, then you have a reasonably limited amount of exposure should you choose to buy without inspections. Most home inspectors are pretty thorough and so while there are always things that a home inspector misses, a pre-inspection should give you a good sense of what you are buying. After reviewing the report, if you feel that the report is thorough, it may be a reasonable risk to waive inspections, understanding that doing so may open you up to unanticipated expenses. However, this may be a way to help you win a home that is receiving multiple offers.

If the home has not been pre-inspected, then it’s quite risky to make an offer without planning to inspect the home. If you happen to be a contractor and you feel comfortable assessing a home on your own, that’s one thing. But if you don’t have any experience with contracting or any experience with being involved in the maintenance of your own current home such that you feel very comfortable assessing the conditions of homes, you may be poorly equipped to get a handle on the condition of the home you’re buying. You could be looking at tens of thousands of dollars of unexpected expenses, depending on the size of the home. This is something you would need to weigh in deciding whether or not that’s an acceptable risk to you in order to be the successful bidder. It’s not a course of action I would recommend, but you may decide it’s the only way you’re ultimately going to get the house you want. If that’s the case and you do move forward waving inspections, you do need to keep in mind that if you later find problems with the home, the only person responsible for taking care of the cost of related repairs is you – not the prior owner, and not the Realtors. So do proceed with caution!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Feb 21, 2021 | Blog, Buyers, Buying Conditions, Home Staging, Inspections, Market Trends, Property Updates, Property Value, Real Estate, Sellers, Selling Conditions

Sometimes it seems like everything is breaking around our house and we get behind on repairs. Isn’t there some level of wear and tear buyers of “previously enjoyed” homes are expecting to have to accept?

The process of selling and buying a home involves many fine lines. How far do you take preparing your home for sale? Do you really need to address all of the items suggested by your agent, the home stager or the home inspector who did a pre-inspection? Do you really have to attend to everything your family has broken or worn out over the years? Anything that could come up on an inspection, if you know about it, really must be repaired or disclosed. My vote is repair. Even with items that are very obvious, when an inspector gets involved, he may blow the issue out of proportion and something that might have cost you $1000 to repair before you listed ends up costing you $3000 on the inspection request. If it’s something an inspector might find, you can bet he will find it and you will be expected to cover the cost of repair anyhow, so you might as well repair upfront.

Many buyers actually get quite nervous during the home inspection (also known as buyers remorse). If you happen to get one of these buyers, it is possible that they could walk away from your deal if the inspection concerns feel too weighty to them. After you actually receive and negotiate the offer, the last thing you want to do is lose the buyer over items that you could have fixed but that you didn’t think anyone would notice or care about! In today’s market, they notice, they care. Sometimes they are willing to let you pay for the repair. Sometimes they just walk. Don’t take any chances. If you suspect it is likely someone would seek a repair, get it done!

Buyers, as much as I advocate for sellers to take care of the wear and tear items on their homes, it is important for you to be reasonable on your inspection requests as well. If you see an item that needs to be fixed while you are touring the home, take that into account when you make your offer and do not revisit it on the inspection. Inspection requests are supposed to be for items you didn’t know about and didn’t have a chance to adjust for in making your offer. Again, it’s a fine line buyers also walk in deciding what are fair and appropriate inspection requests of a seller.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Dec 8, 2020 | Buyers, Buying Conditions, Home Staging, Inspections, Listings, Market Trends, Marketing, Property Updates, Real Estate, Sellers, Selling Conditions

If our home is on the market, how long is it ok to keep our decorations up?

In this incredibly dark time of the year, and even more so in this difficult holiday season as we continue to muddle through this global pandemic, festive holiday décor certainly helps to brighten everyone’s day, so if your home is on the market, it is certainly a good idea to tastefully decorate for the holidays. This year might be the year to embrace an inflatable (maybe a large Santa for example) to bring a little extra levity to the neighborhood! Even if your home is vacant, a seasonal wreath on the front door is a nice touch to welcome guests. We have been unusually busy this fall, so presentation remains important, even when its cold and snowy outside.

Once we start 2021 (and yes, we are all quite eager to put an end to 2020), if your home is on the market, it is important to have your holiday decorations down and stored as quickly as possible, ideally by January 2nd! Our spring market should jump into high gear as soon as we hit mid-January. Buyers themselves will have put the holidays behind them and will enter the new year with a new sense of urgency to find their new home. Once the holiday celebrating has past, decorations quickly look tired, so take them down and store them for another year. If you enjoy door wreaths, that could remain as long as it is more “wintery” and less holiday.

And don’t forget my other wintertime showings tips – lights on for showings, and use the highest acceptable wattage. Keep walks and driveways free of snow and ice. If you’re not going to be out or too long, a fire in the fireplace is also a nice idea. Thermostat at a warm, cozy temperature (Buyers will not embrace a home if it feels chilly). Boot mats by the front door to save your floors.

Enjoy the holidays – stay warm and safe!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Nov 30, 2020 | Blog, Buyers, Buying Conditions, Home Staging, Inspections, Market Trends, Property Updates, Property Value, Real Estate, Sellers

If there was one thing you would advise us to do to our home as we continue our months “at home,” in this global pandemic, what would that be?

Whether you are planning to sell your home this coming year or not, the best thing you can do to your home is a home inspection! We all live in our homes but rarely take the time to stop and give them a careful look. Weather beats up the outside of our homes year round. Caulking fails, flashing fails, paint peels and exposes wood to rot. We forget to clean our gutters on a regular basis – gutters and downspouts fill with decaying debris, causing water to back up into our homes and cause mold problems. We forget to have our furnaces serviced and fittings loosen and cause condensate to leak and rust our furnaces. The list goes on and on. Simply living in and not doing a regular check up on your home, you are leaving it open to the possibility of major repair bills later and major depreciation in your investment’s value. A home inspection will give you a to do list of projects to tackle throughout the year to keep your home in great shape and maintain its value!

Whether you are planning to sell your home this coming year or not, the best thing you can do to your home is a home inspection! We all live in our homes but rarely take the time to stop and give them a careful look. Weather beats up the outside of our homes year round. Caulking fails, flashing fails, paint peels and exposes wood to rot. We forget to clean our gutters on a regular basis – gutters and downspouts fill with decaying debris, causing water to back up into our homes and cause mold problems. We forget to have our furnaces serviced and fittings loosen and cause condensate to leak and rust our furnaces. The list goes on and on. Simply living in and not doing a regular check up on your home, you are leaving it open to the possibility of major repair bills later and major depreciation in your investment’s value. A home inspection will give you a to do list of projects to tackle throughout the year to keep your home in great shape and maintain its value!

You may not think about this until you go to sell your home. Some of the wear and tear may be obvious to a buyer, who will typically have checked out every available home, be able to see signs of your “benign neglect,” and pass on yours because of its comparatively negative condition. Even if a buyer doesn’t’ notice at first, there is no doubt that a home inspector will notice! After working hard to get your home sold, you may find yourself in the all too common situation of being presented with a long list of inspection requests that you need to complete in order to hold your deal together, or worse yet, a buyer who backs out of your deal because the house needs “too much work,” leaving you in the position of having to fix everything and start all over again. A homeowner should expect simply keeping a home in acceptable condition will cost them $3,000 – $10,000 a year, depending on the size of the home – some years will be more if its time for a major project, and some less. If you’re not investing this, chances are someday you will when you are faced with a long list of inspection issues.

So while you remain “at home” waiting for the day the vaccine arrives, why not give your home a check up and attend to its needs! Give me a call if you need the names of reputable local inspectors.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Oct 5, 2020 | Contracts, Inspections, Listings, Real Estate, Sellers

We hear that selling a home can be a trying process. They say forewarned is forearmed. Any annoyances a seller should be expecting?

We hear that selling a home can be a trying process. They say forewarned is forearmed. Any annoyances a seller should be expecting?

Below is a short list of many of the “joys” sellers might experience during the listing process. Being aware that these are possibilities will hopefully help you take them in good humor if they happen to you!

- The agent showing your home will miss appointments and not call or show up.

- Appointments will be made and cancelled at the last minute.

- Some showings will last about five minutes and some will last 3 hours.

- Agents showing your home will forget to turn lights off.

- Agents showing your home will let your pets out (best to remove them from your home for showings) or your neighbor’s pet in.

- Agents will provide unhelpful feedback – buyers buy homes when they attach emotionally to a home and when they don’t, their feedback is often nonsensical.

- Agents will not provide any feedback – incredibly annoying, I know.

- Expect lowball offers (at least it is a starting point).

- Things will come up on the inspection that you had no idea were wrong with your home and you will be sure the inspector made a mistake or the buyer will make ridiculous inspection requests. Remember this easy rule of thumb – if the requests total less than 1% of the sales price, its usually best to agree to the requests, regardless of how ridiculous they might be.

- The buyer will ask to bring in contractors for estimates for work they want to do after the closing at the seemingly most inconvenient times.

- The property might not appraise at what you are selling it for – with the hot market we are in and with homes often selling in bidding wars with multiple offers, there is a risk you might have to make a downward adjustment in your sales price.

- The closing date on the contract may change. Again, lenders are overwhelmed right now and \many closings have been delayed, sometimes for a week or more. This does not mean that your buyer cannot buy your home – it just means lenders are overwhelmed and missing deadlines – be prepared to be patient.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jan 20, 2020 | Blog, Buyers, Inspections, Mortgage

We’re first time home buyers. Where do we begin? (continued from last week)

For those of who just picking up the conversation today, check out my blog at www.askkathe.com to read the past two weeks’ introduction to the home buying process. If you are following along, so far you have gotten pre-approved for your mortgage, researched and chosen a buyer’s agent to be your advocate, saved money for your down payment, shopped for a home and gotten one under agreement. Now the fun continues!

For those of who just picking up the conversation today, check out my blog at www.askkathe.com to read the past two weeks’ introduction to the home buying process. If you are following along, so far you have gotten pre-approved for your mortgage, researched and chosen a buyer’s agent to be your advocate, saved money for your down payment, shopped for a home and gotten one under agreement. Now the fun continues!

Once you have a home under agreement and have deposited your hand money, you will be ready to schedule your inspections. Your buyer’s agent should provide you with guidance in finding reputable home inspectors. You will want to consider scheduling a general home inspection as well as inspections for radon, wood boring insects (termites), mold, and possibly of the sewer lines. If the home has a septic system you will absolutely want to fully inspect the system – they are quite costly to replace. If there is a well on the property, you will want to test both the water quality and the capacity of the well. You may also need to have specialists evaluate aging components such as the roof. You generally have 10 – 14 days to complete your inspections and at the end of that period, you will need to make a request of the seller if you would like any items addressed. To reach a successful conclusion of inspection negotiation, it’s a good idea to keep some simple tips in mind. First, anything on the disclosure should have been considered when you were making the offer – its not a great idea to revisit disclosed items. For example, if the seller disclosed that the roof is at the end of its useful life, asking for money toward a new roof is unlikely to be well received. The same can be said for items you could have easily seen. If the inspector notes that the driveway is cracked and you should have seen it while visiting the home, asking for the seller to pay for a new driveway will also not be well received. So when deciding what, if anything, to request of the seller, eliminate disclosed items and things you noticed when visiting the home and then turn your focus to the items that concern you most. Of course, if there were multiple offers and you were the winner in a bidding war, you may not be able to ask for much if anything as there is likely another buyer on standby! Ultimately, you and your seller will need to reach a compromise on the inspection issues and that agreement will be formalized in a written addendum to your Agreement of Sale.

At the same time you are working through inspections, you will also need to make application for your financing. This must be complete (in other words, you must have all of your paperwork to your lender) within 7 days of the final Agreement of Sale. Applying for a mortgage these days can seem quite challenging – be prepared for the lender to ask for what will seem like a mountain of documents. And do NOT make any major purchase until after you close on your home – changes to your outstanding debt at this point could affect your ability to qualify for a loan at all! Once you get through inspections and mortgage application, it should be smooth sailing. We will cover the final step in the process next week!

307 Grant Street, Sewickley – NEW LISTING!

307 Grant Street, Sewickley – NEW LISTING!

Incredible central Village home in a phenomenal neighborhood with flat, fenced yard, 2 car garage. Newly remolded kitchen and baths. Upstairs features 3 bedrooms, 2 baths. The main level includes living, dining and family rooms, eat-in kitchen and den. Charming covered back porch. $725,000. Join me for our open house Sunday, 1-3pm.

213 Chestnut Road

213 Chestnut Road

Beautifully remodeled Sewickley Village Victorian with high ceilings, open floorplan and fabulous original architectural detailing. Wonderful newer master suite with stylish newer bath. Four finished levels of living space including lower level gameroom. Flat backyard, two car detached garage. In a wonderful Village neighborhood, within a very easy walking distance to Village shops and restaurants. $795,000

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jan 2, 2020 | Blog, Buyers, Home Staging, Inspections, Sellers

Sometimes it seems like everything is breaking around our house and we get behind on repairs. Isnt there some level of wear and tear buyers of “previously enjoyed” homes are expecting to have to accept?

The process of selling and buying a home involves many fine lines. How far do you take preparing your home for sale? Do you really need to address all of the items suggested by your agent, the home stager or the home inspector who did a pre-inspection? Do you really have to attend to everything your family has broken or worn out over the years?

The process of selling and buying a home involves many fine lines. How far do you take preparing your home for sale? Do you really need to address all of the items suggested by your agent, the home stager or the home inspector who did a pre-inspection? Do you really have to attend to everything your family has broken or worn out over the years?

Anything that could come up on an inspection, if you know about it, really must be repaired or disclosed. My vote is repair. Even with items that are very obvious, when an inspector gets involved, he may blow the issue out of proportion and something that might have cost you $1000 to repair before you listed ends up costing you $3000 on the inspection request. If its something an inspector might find, you can bet he will find it and you will be expected to cover the cost of repair anyhow, so you might as well repair upfront.

Many buyers actually get quite nervous during the home inspection (also known as buyers remorse). If you happened to have gotten one of these buyers, it is possible that they could walk away from your deal if the inspection concerns feel too weighty to them. After you actually receive and negotiate the offer, the last thing you want to do is lose the buyer over items that you could have fixed but didn’t think anyone would notice or care about! In today’s market, they notice, they care. Sometimes they are willing to let you pay for the repair. Sometimes they just walk. Don’t take any chances. If you suspect it is likely someone would seek a repair, get it done!

Buyers, as much as I advocate for sellers to take care of the wear and tear items on their homes, it is important for you to be reasonable on your inspection requests as well. If you see an item that needs to be fixed while you are touring the home, take that into account when you make your offer and do not revisit it on the inspection. Inspection requests are supposed to be for items you didn’t know about and didn’t have a chance to adjust for in making your offer. Again, its a fine line buyers also walk in deciding what are fair and appropriate inspection requests of a seller.

321 Merriman Road, Sewickley Heights

321 Merriman Road, Sewickley Heights

An exceptional opportunity to live on 42 gently rolling acres in very desirable Sewickley Heights. Beautifully remodeled, this classic historic colonial perfectly blends sophisticated living, modern amenities, and stunning architectural details throughout! Featuring 6 bedrooms, 7 full and 2 half baths, this home boasts a grand entry hall, large open kitchen and inviting two-story family room, well-cabineted butler’s pantry, two mudrooms, handsome private den, spacious formal rooms, main-level gameroom with three walls of windows, large bedrooms and fabulous master suite with dressing room. Glass doors open to charming patios which spill out onto the sprawling lawns! Wonderful pool, outdoor kitchen and living space with impressive outdoor fireplace offer ideal venues for warm-weather entertaining and fun! Four car garage. $4,250,000

49 Woodland Road

49 Woodland Road

Boasting newer kitchen and baths in a sought after Village neighborhood, 49 Woodland offers a unique opportunity for newer construction in the heart of Sewickley Village. The main level master offers hard-to-find convenience – with 3-5 additional bedrooms upstairs. The beautifully remodeled white kitchen opens to family room and sunroom, with 3 walls of windows overlooking the private backyard. The three car attached garage offers another hard-to-come buy amenity in the Village, as does the finished lower level! $1,625,000.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Sep 17, 2019 | Blog, Inspections, Sellers

We want to sell our home “as is.” Is this possible?

If everything comes together perfectly, then yes, it is possible to sell your home “as is” — here is what you will need to do to make that happen!

If everything comes together perfectly, then yes, it is possible to sell your home “as is” — here is what you will need to do to make that happen!

First, you must start by having your home pre-inspected. Very few buyers would consider waiving inspections if the home has not been a qualified home inspector, with reports provided to prospective buyers. You will then need to take the inspection and use it to thoroughly complete the disclosure, making sure that you clearly identify all deficiencies that you aren’t planning to repair. If there are larger items such as a high radon reading, suspected mold or knob and tube wiring, you should at a minimum get estimates for the repairs. All of these things, the disclosure, the inspection reports, and the estimates, all need to be provided to prospective buyers.

The second step to a successful “as is” sale is to price the home for the condition you now know it to be in. The advantage to this approach is being able to tell buyers that the price reflects known condition. You will be far less likely to have requested price adjustments later for unknown issues. It is very important that your chosen price reflect the condition you now know your home to be. For example, if your home has knob and tube wiring, you can’t expect to receive the same price as a similar home that had been rewired. Rewiring is generally speaking a $20,000 – $40,000 project.

Finally, a great marketing strategy is key. To truly achieve an “as is” sale your agent will need to drive in significant traffic and generate multiple offers so that the bidding buyers are willing to waive all inspections in order to be the winning bidder.

I just orchestrated this approach on one of my listings and it worked perfectly. A seller I represented wanted an “as is” sale, did the pre-inspections, obtained estimates and priced very well. We ended up with 4 offers, inspections waived, and ended up selling at nearly 10% over list price! The up-front effort was well worth the end-result!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jul 16, 2019 | Blog, Inspections

What kinds of items would be viewed as “hot buttons” for home buyers on inspections?

If you are a home seller, there is an ever increasing list of items that you will be expected to address if any are discovered on your home inspection. Given that, if you are thinking about selling your home, it would be a good idea to determine if any of these conditions exist at your home and remedy them prior to listing your home. Items that sellers are generally expected to address these days include:

If you are a home seller, there is an ever increasing list of items that you will be expected to address if any are discovered on your home inspection. Given that, if you are thinking about selling your home, it would be a good idea to determine if any of these conditions exist at your home and remedy them prior to listing your home. Items that sellers are generally expected to address these days include:

Radon: if your home exceeds 4.0pCi/l, you will be expected to remediate the radon, even if it was a low reading when you bought the home. Radon varies over time. The estimated cost for a system is approx.. $1000.

Mold: If there is mold anywhere at all, you will be expected to have it remediated. Basements and attics are the most obvious places mold hides out, but be sure to check showers and under sinks.

Electrical: If you have knob and tube wiring, you will likely be paying for it to be removed and replaced, unless you price your home with a rewire in mind and disclose its presence. If your home has any Pushmatic brand electrical panels, buyers will also expect those to be replaced.

Broken seals: if you have thermopane windows, doors or skylights in your home, buyers will expect you repair the broken thermo seals. This is evident because the windows have a cloudy look to them. There are a few companies in Pittsburgh that can do this reasonably affordably. If you disclose the broken seals and price accordingly, you might be able to avoid repair.

Septic/sewer: Sewer lines are the newest “must do” inspection. If a buyer finds roots in your sewer line, at a minimum you will be expected to clear the roots from the line, but if they are bad you will be expected to line or replace the line. This can be extremely costly so I highly advise that you camera your own lines in advance of selling and get them in good shape.

You can be certain that if any of these conditions exist in your home, you will be expected to remedy the condition unless you disclose its presence and price accordingly.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jun 4, 2019 | Blog, Buyers, Inspections, Real Estate, Sellers

My home has so many special features. I think it would be best if I were at showings so I could explain them to prospective buyers. Is that ok?

When you are selling your home, its normal to think that only you can fully convey your home’s fine qualities to a buyer. This leads some sellers to consider the possibility of being home for showings, so that they can make sure that the buyer prospects appreciate all of the home’s amenities. While this may seem sensible to a seller, nothing could be further from the truth!

When you are selling your home, its normal to think that only you can fully convey your home’s fine qualities to a buyer. This leads some sellers to consider the possibility of being home for showings, so that they can make sure that the buyer prospects appreciate all of the home’s amenities. While this may seem sensible to a seller, nothing could be further from the truth!

When buyers visit your home, it is important that they be allowed the space to imagine the home as their own. This starts, of course, with home staging, so that the home is not overly personal when the buyers arrive. But it extends to allowing them to tour the home alone with their buyer agent. For buyers to buy a home, they must bond to a home. For buyers to bond to a home, they need to be free to relax in your home and chat with their agent about what they would do to make the home their own. This will not happen if you are present. So what can you do to make sure they appreciate your home’s qualities? Hire a listing agent who will design a custom brochure for your home that is available when buyers visit your home. Such a brochure is your best ammunition – they can take it home and recall all of your home’s wonderful features and get their questions answered as well.

Giving the buyers their space extends to the home inspections as well. The period during the home inspection is one of normal buyer remorse. Did we buy the right home? Will a better home become available? Allowing buyers the freedom to return to your home alone will allow them to bond again to your home and stay committed to it during the sometimes difficult inspection process.

In fact, the only time you should interact with your buyer is at the closing. From initial showing to return visits, inspections and walk-throughs, you should always vacate your home and give the buyers their space!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | May 14, 2019 | Blog, Inspections, Listings, Sellers

Selling our homes seems like it will be a very stressful endeavor. Is there any way to make it any easier on us?

Once you have lived long enough, you realize that if there is something to be done, there is usually an easy way and a hard way. When it comes to selling your home, why not make it easy? If you make it easy, you are far likelier to have a successful transaction.

First and foremost, make access to your home easy for buyers. Use a lockbox and always be ready to show. Busy agents with serious buyers don’t have time to track down keys held by listing agents, or worse yet, schedule showings around your listing agent’s schedule. You can’t sell if you don’t show – make it easy with lockbox access (which notifies your agent immediately every time it is accessed) and be ready to accommodate last minute showing requests.

Make negotiations easy. When you do receive an offer, do not get upset or offended. Every buyer approaches negotiations differently. Some will need to give you long letters explaining their analysis of value. Don’t take it personally – just understand that it is a unique opportunity to understand how buyers perceive your home. If one buyer is bold enough to tell you, the chances are there are others with the same concerns. While you likely put your heart into the home, you are leaving and need to detach. Be pleasant and non-defensive in your response and try to focus on the one or two points in the offer that concern you the most. The more flexible and good-natured you appear, the easier it will be to get and keep the buyer in the deal. Be easy to reach during negotiations as well. The more protracted the negotiations, the greater the chance the buyer’s interest will wane and you will lose the deal.

Make inspections easy. I have said this many, many times, but if there are conditions that exist that are called out by the inspector and they were not on your disclosure, you should expect to pay for them or lose your deal. You can make this very easy on both you and the buyer – have your home pre-inspected – then a buyer can make an offer knowing the condition at the time of offer and you should sail through the inspection.

Sound easy? It is! Keeping these simple concepts in mind will make your home sale much easier.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | May 6, 2019 | Blog, Buyers, Inspections, Sellers

I’ve heard that agreements on many homes have fallen through lately from home inspections – why is that?

Our market has traditionally been one where buyers know they are buying old homes and allow the seller some leeway in not presenting a “perfect” home from an inspection standpoint. However, in many parts of the country, this is not the case. Sellers are expected to remedy all issues noted by home inspectors prior to closing. As more and more people migrate here from other parts of the country, our prices are going up, but so are the buyers’ expectations as to a seller’s responsibility for concerns discovered on a home inspection. At the same time, inspectors are getting significantly more particular. And so yes, it is absolutely possible to have purchased a home only two years ago and have new concerns arise that clearly existed and were overlooked when you bought your home. And yes, it is equally possible that you will be expected to fix them and if you refuse, your sale might fall through.

Our market has traditionally been one where buyers know they are buying old homes and allow the seller some leeway in not presenting a “perfect” home from an inspection standpoint. However, in many parts of the country, this is not the case. Sellers are expected to remedy all issues noted by home inspectors prior to closing. As more and more people migrate here from other parts of the country, our prices are going up, but so are the buyers’ expectations as to a seller’s responsibility for concerns discovered on a home inspection. At the same time, inspectors are getting significantly more particular. And so yes, it is absolutely possible to have purchased a home only two years ago and have new concerns arise that clearly existed and were overlooked when you bought your home. And yes, it is equally possible that you will be expected to fix them and if you refuse, your sale might fall through.

This can often leave a seller feeling like they are the unlucky one who got stuck holding the “hot potato.” As the years pass, the list of “hot button” issues mounts and if you are the owner when the issue is discovered, you will be the one paying the bill even though the home was bought and sold many times in advance of your ownership. These hot button issues include items such as old sewer lines, radon, mold, damp basements, lead water lines, asbestos (fireplace inserts, duct tape, pipe wrap or flooring) knob and tube wiring and pushmatic electric panels. If your home has any of these issues, you should figure you will be the one footing the bill and address them before they become an issue on a home inspection.

The best way to prevent an inspection fall through or an unexpected bill for defects is to have your home inspected before you put it on the market. A pre-inspection will allow you the opportunity to fix those items that can be fixed and disclose the rest to save yourself from a laundry list of requests. Be sure not to ignore the small stuff that comes up or that you know is wrong. For example, when I list a home, I specifically ask sellers if all of their windows open, stay open, shut and lock, and if any are cracked or have broken seals. Sellers more often than not disclose no issues with their windows and yet it is one of the most frequent inspection deficiencies. Take the time to do your homework – get your home inspected – repair or disclose any possible concerns – and save yourself from a long last-minute repair list and potentially even from losing your sale.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Apr 25, 2019 | Blog, Buyers, Inspections, Mortgage, Sellers

Is the highest offer always the best offer in a multiple offer situation?

For those of you looking for a quick answer, the answer is a resounding no! For those of you wondering why, read on!

For those of you looking for a quick answer, the answer is a resounding no! For those of you wondering why, read on!

There are many important components to an offer, and price is only one of them! First is financial ability to perform. An offer is worth nothing if the buyer is unable to pay for the home. A cash offer with proof of funds is your best bet, but most buyers take mortgages. If the offer is contingent upon the buyer getting a mortgage, make sure you receive a pre-approval letter from a local, well-reputed lender (and not an internet lender).

Second, make sure you receive a substantial amount of hand money. Hand money is all you have if a buyer backs out of the deal. Sometimes buyers just change their minds. Maybe a house they like better comes on the market. Maybe they figure out that the home needs more work thab they originally imagined and the remodeling costs get too high. Maybe they take a new job that is too far from your home. There are many reasons why buyers change their minds and if you lose your buyer, you will want to be sure you have a decent amount of hand money to compensate you for the loss.

Finally, some buyers will offer more for a home with the expectation that they will “beat you up on your home inspection.” Your best line of defense against these tactics is to make sure that you have been exceptionally thorough in your disclosure so that there is nothing (or almost nothing) wrong that you haven’t already told them about. A pre-inspection is a great way to make sure that your home is in great shape and that all issues are disclosed – it will save you money in the long run. Some buyers will even waive inspections if you provide a pre-inspection from a quality home inspector, which is the best scenario of all!

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Feb 12, 2019 | Blog, Inspections, Listings, Market Trends, Real Estate

Our neighbor just had to replace their sewer line – is that a common home inspection repair?

Sewer lines have become as radon was 20 years ago – today’s hot button for home buyers. In some boroughs (Mt Lebanon, for example) the borough now requires that before a home seller can transfer ownership, the sewer line must be scoped and must be without issues. Here in the Sewickley area, we do not have any boroughs imposing any such requirement on home sellers, but many buyers today do have a scope performed of the sewer line as part of their home inspection. And yes, if issues are discovered, they do expect the seller to remedy them. If a sewer line needs to be replaced, the cost will likely be between $5,000 and $10,000.

Sewer lines have become as radon was 20 years ago – today’s hot button for home buyers. In some boroughs (Mt Lebanon, for example) the borough now requires that before a home seller can transfer ownership, the sewer line must be scoped and must be without issues. Here in the Sewickley area, we do not have any boroughs imposing any such requirement on home sellers, but many buyers today do have a scope performed of the sewer line as part of their home inspection. And yes, if issues are discovered, they do expect the seller to remedy them. If a sewer line needs to be replaced, the cost will likely be between $5,000 and $10,000.

Sewer lines are not something we think about on a daily basis. As long as we don’t have back-ups, we assume that all is well with the line. But this is not necessarily the case. With older homes, sewer lines were made of terracotta pipe and this can break easily and can also be easily infiltrated by tree roots. If you live in an older home and haven’t replaced your sewer line, there is a good chance you have some issues.

Paying for a sewer camera test is not anyone’s idea of a good time, but if you are contemplating a sale of your home, it is probably a smart, pro-active thing to do. If you discover a problem in advance, there may be some cost-effective options for you to solve the problem without a full replacement of the line. Sewer lines can often by lined with a plastic liner. Tree roots can often by removed by hydrojetting. If you wait for a buyer to perform the test, you may get stuck with a full new line — the buyer might not accept one of the compromise options. So its best to explore the sewer line now, before it becomes an issue, and make any needed corrections.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Jan 8, 2019 | Blog, Buyers, Home Staging, Inspections, Listings, Market Trends, Property Updates, Real Estate

We last updated our home twenty years ago and are now ready to downsize. Does it make sense to put it on the market at a lower price or do we have to make updates before we list?

You absolutely do not need to update your home before you list! I’m sure that comes as a relief to you. However, if the last significant updates you made were twenty years ago, you must price accordingly. Even if your bath tiles are white, for example, and not a turn off, the size and style of tiles has changed in two decades and the baths, although neutral, will feel dated to buyers. One of the biggest mistakes sellers make is to note what their neighbor’s home sold for and price theirs accordingly. If the neighbor had new baths (as opposed to neutral baths) or a new kitchen, or new paint colors… they will get significantly more money for their home. The key to selling with no updates is to get a likely value in “as is” condition from a local expert – I can help you with that! It is important to be clear when pricing, however, what you intend to do before listing – some sellers have projects planned but not completed and that would be important to take into account. As long as you price your home right, your home will sell without updates.

You absolutely do not need to update your home before you list! I’m sure that comes as a relief to you. However, if the last significant updates you made were twenty years ago, you must price accordingly. Even if your bath tiles are white, for example, and not a turn off, the size and style of tiles has changed in two decades and the baths, although neutral, will feel dated to buyers. One of the biggest mistakes sellers make is to note what their neighbor’s home sold for and price theirs accordingly. If the neighbor had new baths (as opposed to neutral baths) or a new kitchen, or new paint colors… they will get significantly more money for their home. The key to selling with no updates is to get a likely value in “as is” condition from a local expert – I can help you with that! It is important to be clear when pricing, however, what you intend to do before listing – some sellers have projects planned but not completed and that would be important to take into account. As long as you price your home right, your home will sell without updates.

Before deciding to list “as is,” however, it is a good idea to consider what the cost of recommended updates would be and what they might yield you if you make the investment. Usually, when updates are made right before a sale and are in line with current design preferences, your home will sell faster and the higher price you receive will be far greater than the cost of the updates. If this is something you would like to consider, I would be happy to meet with you to discuss what you might update and how the updates might increase your value. You could then make an informed decision about whether or not to list “as is” or update.

In the end, you may decide that you value the simplicity of an “as is” listing and the increased price realized is not worth your time and the stress of a project. Even in that case, it’s a good idea to still stage the home for sale by decluttering and giving it a good scrub down (including windows and carpets). Homes that are clutter free and have been recently deep cleaned will also sell faster and yield a higher sales price, even if they are not as updated as buyers might prefer.

[contact-form-7 id="115311" title="Get More Information Form"]

by Kathe Barge | Oct 10, 2018 | Home Staging, Inspections, Listings, Market Trends, Pittsburgh, Property Updates, Real Estate, Sewickley